The CoT report is longer-term sentiment indicator; for short-term indications see theIG Client Sentiment page.

The most recent Commitment of Traders (CoT) report showed large speculators flipping net-short in silver for the first time in nearly 15 years, an unusual occurrence indeed. While in gold, the same group of traders are still holding a relatively large number of contracts. What might this mean moving forward for the relationship between the two?

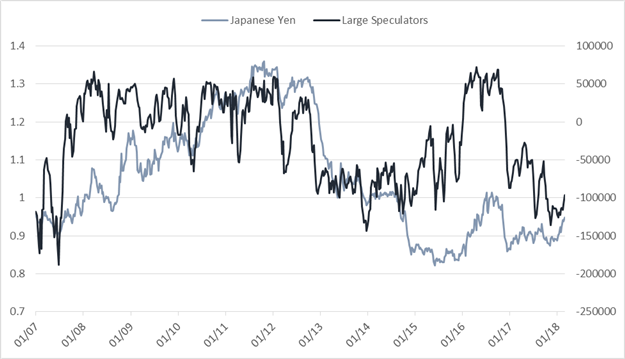

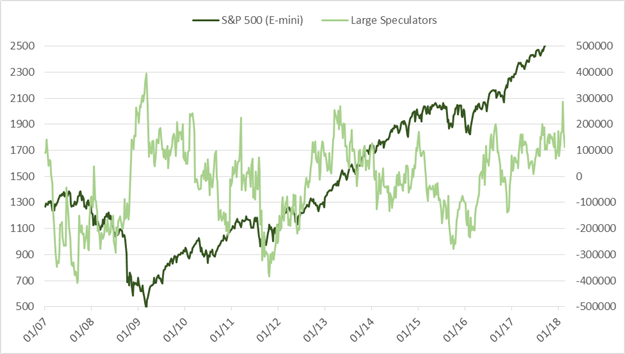

Every Friday, the CFTC releases the weekly report showing traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below, we’ve outlined key statistics regarding net positioning of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders are largely known to be trend-followers due to the strategies they typically employ, collectively. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing how their activity could impact future price fluctuations.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

Large speculators were net sellers for a 4th week in a row, flipping to net-short for the first time since April 2003. It's not an extreme amount of contracts short at -1508, but it is certainly unusual for them to be short by any number of contracts. During the bull run up to the 2011 peak and bear market since large specs have held long. Any time their position has moved close to the zero-line it has been close to a trade-able low in silver. This time may be no different, with the flip to net-short as an indication of capitulation.

On the weekly time-frame, silver is coiling up between the 2003 trend-line and another running down off the 2016 high. At some point the precious metal will break one way or another, and if it is does to the upside there will be plenty of fuel to drive price higher as the market repositions itself. If a break on the downside takes shape (assuming large specs are still short), they could finally be on the right side of the decline dating back to 2011.

See how sentiment could tie into theDailyFX Forecasts and Top Trading Opportunities for 2018

At 178k contracts, large speculators are holding a long position that is in the top 25% in terms of size when compared to the past five years. Quite a different situation than what we are seeing in silver. What might this mean?

The disparity in positioning obviously shows more confidence in gold moving higher, but also means that if precious metals start to rally, traders may scramble to buy silver more so than gold. The gold/silver ratio is at a long-term extreme, suggesting this may indeed be the case. As of last month, in at least 20 years, the ratio of gold to silver has only been marginally higher than where it is now only once, back in February 2016.

Conversely, if precious metals continue to trade lower, with silver traders already short and gold traders still quite long, liquidation may unfold in gold as traders are caught flat-footed.Bottom-line, either way there are potentially more buyers on the sideline in silver and more sellers available in gold.Outperformance may soon be in store for silver.

Whether you are a new or experienced trader, we have several resources available to help you; indicator for trackingtrader sentiment, quarterlytrading forecasts, analytical and educationalwebinars held daily,trading guides to help you improve trading performance, and one specifically for those who arenew to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, pleaseSIGN UP HERE

You can follow Paul on Twitter at@PaulRobinsonFX